President Joe Biden has been considering forgiving some government student loan debt. Such a move that could help alleviate the weight on borrowers of $1.6 trillion in federal education debt, a figure that has more than tripled in the last 15 years.

As a candidate, Biden had said he supported a plan for Congress to take action, but with no movement on the horizon there, some Democrats are pressuring him to use his executive authority, which could bolster the party’s base before the November elections.

The most frequently cited version of what’s under consideration would involve forgiving $10,000 per borrower. It’s a notion that has been welcomed by some, and called both too much and too little by others.

In the meantime, Biden has been taking more targeted actions.

1. Who would Biden’s plan help?

According to Education Department data as of March 2022, more than 45 million borrowers hold federal student loans, including parents who borrowed for their children’s college education, as well as about 30 of Biden’s own senior staffers. The administration has not yet settled on the proposal’s contours, but aims to focus relief on lower- and middle-income individuals. In earlier discussions, his plan was designed to cover both current and former students, including those who dropped out without completing a degree. About 15.2 million borrowers –- a bit more than a third of the total — could have their federal loans wiped out by $10,000 in debt forgiveness, according to Education Department data.

2. Who would be left out?

An additional 27 million borrowers have debt of between $10,000 and $100,000. Only 3.3 million owe more than that, including about 900,000 who have debt exceeding $200,000, a group that likely includes many current or former graduate students. The Education Department couldn’t say if the forgiveness would extend to parents who borrowed for their children. Biden said he would not agree to calls from progressive Democrats to forgive up to $50,000 in loans per borrower.

3. What has Biden already done?

On his first day in office, he directed the Department of Education to extend a freeze on federal student-loan payments that now runs through the end of August and to keep the interest rate at 0%, which means no accumulation of interest during the freeze. Collection efforts are also paused. The payments were first suspended in 2020 as part of the pandemic relief effort, but do not apply to private loans. Biden’s administration has already been forgiving targeted amounts. That includes most recently the $5.8 billion in debt for students who the government said were defrauded by the defunct Corinthian Colleges Inc., a for-profit college chain. The June announcement said loans held by 560,000 borrowers was the largest discharge in the Education Department’s history.

4. What’s the argument in favor of the debt-canceling plan?

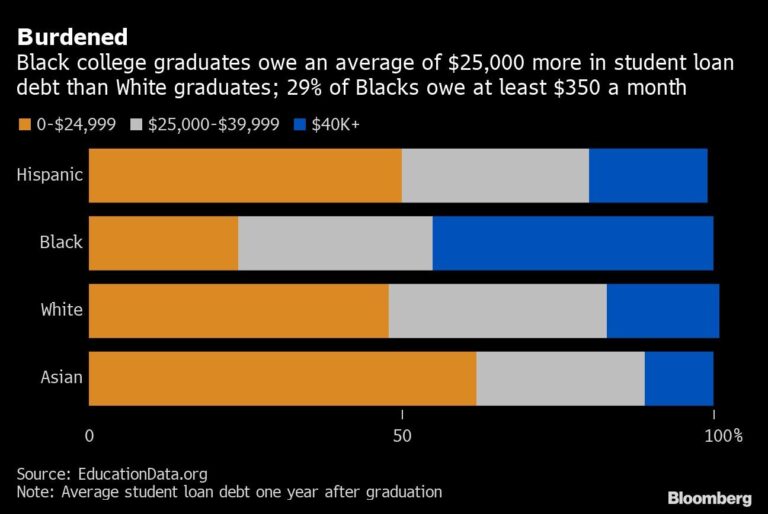

When the idea was first floated during the 2020 campaign, part of the rationale for both debt cancellation and the payments pause was to support a pandemic-weakened economy. That seems less apt now, as the U.S. is confronting the steepest inflation in decades. Some forgiveness could help keep struggling borrowers from defaulting, which can scar credit reports. Some advocates see the issue as generational fairness, saying no previous cohort had to enter adulthood with such a debt burden. There’s also a racial equity element: Forgiving $10,000 in debt would zero out loan balances for 2 million Black borrowers and reduce the Black-White gap in the share of individuals with student debt from 9 to 6 percentage points, according to data Senator Elizabeth Warren cited from the University of California Merced and Princeton University.

5. What do critics say?

That the plan would be unfair to those who have already paid back student loans or who worked their way through college to avoid debt. Some economists point out that in a blanket forgiveness, a portion of the benefits would go to upper-income students, especially those who borrowed for graduate school, a path that can lead to higher-paying professions like law or medicine. Some progressive activists, like Warren, have called for forgiving up to $50,000 in loans, while others have pressed for deeper relief for targeted groups, like students who didn’t finish their degrees. Some student loan advocates stress the importance of making forgiveness automatic, or at least lowering the bureaucratic hurdles that have plagued other student loan repayment programs to help struggling borrowers. And people on all sides of the issue point out that forgiving debt does nothing to alter the economics of education that produced the borrowing in the first place — the rising price tag for higher education.

6. How could forgiveness work?

The administration has not spelled that out yet. One idea, proposed by Matthew Chingos of the Urban Institute, is to tie forgiveness to the resumption of loan repayments when the moratorium is ended. One of the largest challenges for the Education Department will be getting borrowers to begin making payments again after years of them not being required. The job will fall to the loan servicers that are contracted to collect payments and help borrowers get in the habit of paying and stay on track.